Content

Whether you are deploying for the first time or creating a sustainable education program for maximum value creation, explore how you can take the next steps to upskill your users. F&A teams have embraced their expanding roles, but unprecedented demand for their time coupled with traditional manual processes make it difficult for F&A to execute effectively. Finance and IT leaders share a common goal of equipping their organizations with ways to work smarter to enable competitive advantage. This intersection between CFO and CIO priorities is driving more unity in terms of strategy and execution. Unlock capacity and strengthen resilience by automating accounting. Streamline and automate intercompany transaction netting and settlement to ensure cash precision.

The term “outstanding rent” refers to rent due for a period that has already passed. Are not necessarily made immediately they may be late or in advance. Outstanding expenses and unexpired expenses are both a result of this. Sage Fixed Assets Track and manage your business assets at every stage. The right financial statement to use will always depend on the decision you’re facing and the type of information you need in order to make that decision. Learn what you can do to maximize your profits by minimizing your taxes.

What is the Effect of Prepaid Expenses on Financial Statements?

Expenses that are made for future assets always pose a threat of not getting utilised. For example, let’s say a rental agreement is violated, and the landlord terminates the remaining tenure. One can easily track this during a period of accounting if there’s a prepaid account to reflect this expense. To summarize, rent is paid to a third party for the right to use their owned asset. Renting and leasing agreements have existed for a long time and will continue to exist for individuals and businesses.

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Be covered by the rental income, banks and mortgage lenders typically require landlords to have the rent payments coming in before the mortgage payment is due for the same period. However, you’ll discover that you’ll always be required to pay rent one or three months in advance, creating a prepaid rent scenario.

Online Insurance Brokers Market Growing Popularity and Emerging Trends in the Industry

The lessor is allowed to deduct depreciation costs since they still own the rented property. This further lowers the lessor’s taxable income, which also results in a smaller tax obligation. Additionally, by doing it in this manner, the lessor’s annual income can be sufficiently decreased to move into a prepaid rent meaning reduced tax rate, resulting in additional money saved. The prepayment may be amortized by the lessor during the life of the lease. Both the revenue and the tax burden are spread fairly in this way. The danger that the lessor would file forbankruptcyis another significant problem with prepaid leases.

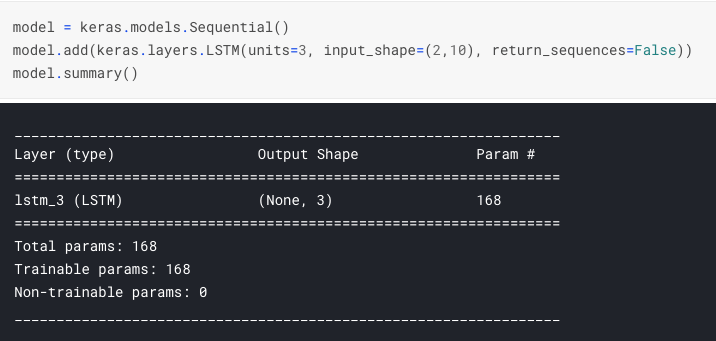

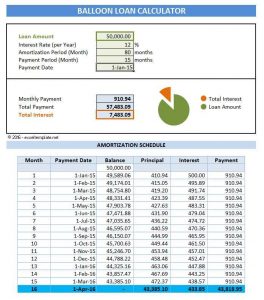

Open a prepaid expenses journal entry in your books at the time of purchase, before using the good or service. Amortization can be defined as paying off a debt in a given period in equal installments. With amortization, the amount of accrual, such as prepaid rent, is gradually reduced to zero, through amortization schedule.

Join Sage

An expense that is paid before it is due is considered prepaid and it is treated as an asset for the business. When a salary is paid in advance to an employee but the employee is yet to work for that period it is called salary paid in advance. When an insurance premium has been paid to the insurance company but the related coverage hasn’t yet begun, this is known as insurance premium prepaid. In the event that such an expense does not appear in the trial balance, they should be added to the respective accounts. This should be reflected on the debit side of the Profit and Loss Account. Advance payment made for an expense has two steps for being recorded and recognised.

What is the difference between rent and prepaid rent?

Prepaid rent is a lease payment made for a future period. A company makes a cash payment, but the rent expense has not yet been incurred so the company has prepaid rent to record. Prepaid rent is an asset – the prepaid amount can be used by the entity in the future to reduce rent expense when incurred in the future.